What are steps to take to help prevent a property insurance claim

Though this may seem counterproductive to our business here at AJR Public Adjusters, we like to provide helpful information. If we can give suggestions to help you protect your property from an insurance claim, that is a plus for everyone involved. We don’t like to see people dealing with the stress of an insurance claim; even when AJR Public Adjusters is the front line to the insurance company, there is still stress on the property owner that we can never alleviate.

Preventing property insurance claims often involves proactive measures to mitigate risks and maintain the safety and security of your property. Here are some steps you can take to prepare and prevent property insurance claims:

- Regular Maintenance: Ensure that your property undergoes regular maintenance checks. This includes inspecting the structural integrity, electrical systems, plumbing, and HVAC systems. Fix any issues promptly to prevent them from escalating into larger problems.

- Risk Assessment: Identify potential risks to your property such as fire hazards, water damage, theft, or natural disasters. Take steps to mitigate these risks, such as installing smoke detectors, fire extinguishers, security cameras, and alarm systems.

- Weatherproofing: Weather-related damage can be a significant risk to your property. Weatherproof your property by sealing windows and doors, reinforcing roofs, and clearing gutters and drains regularly to prevent water damage.

- Security Measures: Implement security measures to protect your property from theft and vandalism. This may include installing security alarms, motion-sensor lights, sturdy locks, and security cameras.

- Insurance Coverage Review: Regularly review your insurance policy to ensure that you have adequate coverage for your property. Consider additional coverage options for specific risks that may not be included in your standard policy. If you have any questions, please reach out to AJR Public Adjusters at 602-795-5227. We can tell you what we suggest from a claim perspective.

- Documentation: Keep thorough records of your property, including photos, receipts, and documentation of valuable items. This will be helpful in the event of a claim, providing evidence of the property’s condition and the value of any lost or damaged items. AJR Public Adjusters uses this information to help document & price your claim for reimbursement.

- Emergency Preparedness Plan: Develop an emergency preparedness plan outlining procedures to follow during a disaster or emergency. Make sure all occupants of the property are familiar with the plan and know what to do in case of an emergency. If a claim should occur, your first call to AJR Public Adjusters will help begin the process. We will help you report the claim and get started immediately with our team to help mitigate your damages and secure an estimate to negotiate for settlement.

- Training and Education: Educate yourself and others who occupy the property about safety procedures and best practices for preventing accidents and injuries. This may include fire safety training, first aid training, and awareness of potential hazards.

- Regular Inspections: Conduct regular inspections of your property to identify any potential hazards or maintenance issues. Addressing problems early can help prevent them from causing more significant damage later on.

- Communication with Insurance Provider: Maintain open communication with your insurance provider. Inform them of any changes to your property or occupancy that may affect your insurance coverage.

By taking these proactive measures, you can help minimize the likelihood of property insurance claims and protect your property from damage or loss.

Even after taking the steps above, if your property suffers a property insurance claim, be sure to have AJR Public Adjusters, telephone number 602-795-5227, handy to call us first to let us help you report your claim and begin the recovery process.

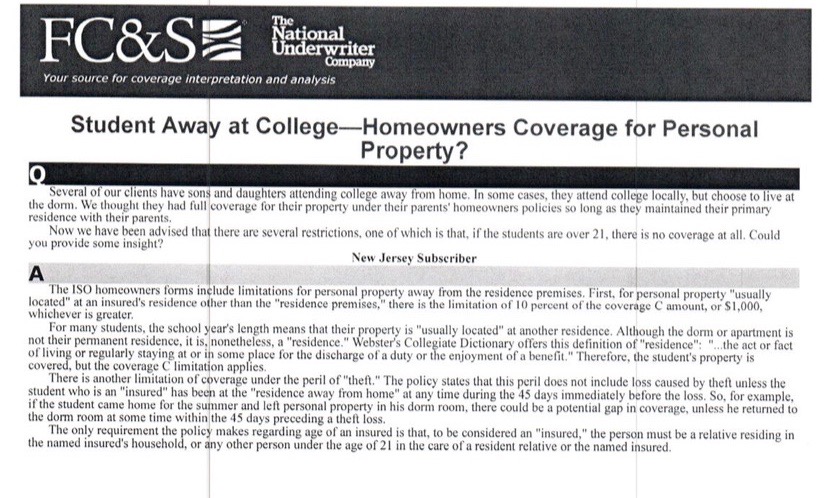

Good luck to all students headed back to college this fall.

Good luck to all students headed back to college this fall.